Aadhar Enabled Payment System (AePS) Services

Empower Your Store: Register for AePS Services and Provide Aadhaar Banking Services

Register for Aadhaar Enabled Payment System (AePS) Services and provide your customers with instant cash withdrawal facilities. Biznext has integrated with all the available banks to enable cash withdrawal and other AePS services for all its partners.

AePS Facility Services

Customers can visit their nearest Biznext AePS agent and do all these transactions using only their Aadhaar Number and Biometric Authentication.

What Services Included in Aadhar Enabled Payment System?

Balance Inquiry:

AePS Agent can check the balance of the customer simply in less than a minute by using Biznext portal or mobile application. We have the best mobile App to do AePS.

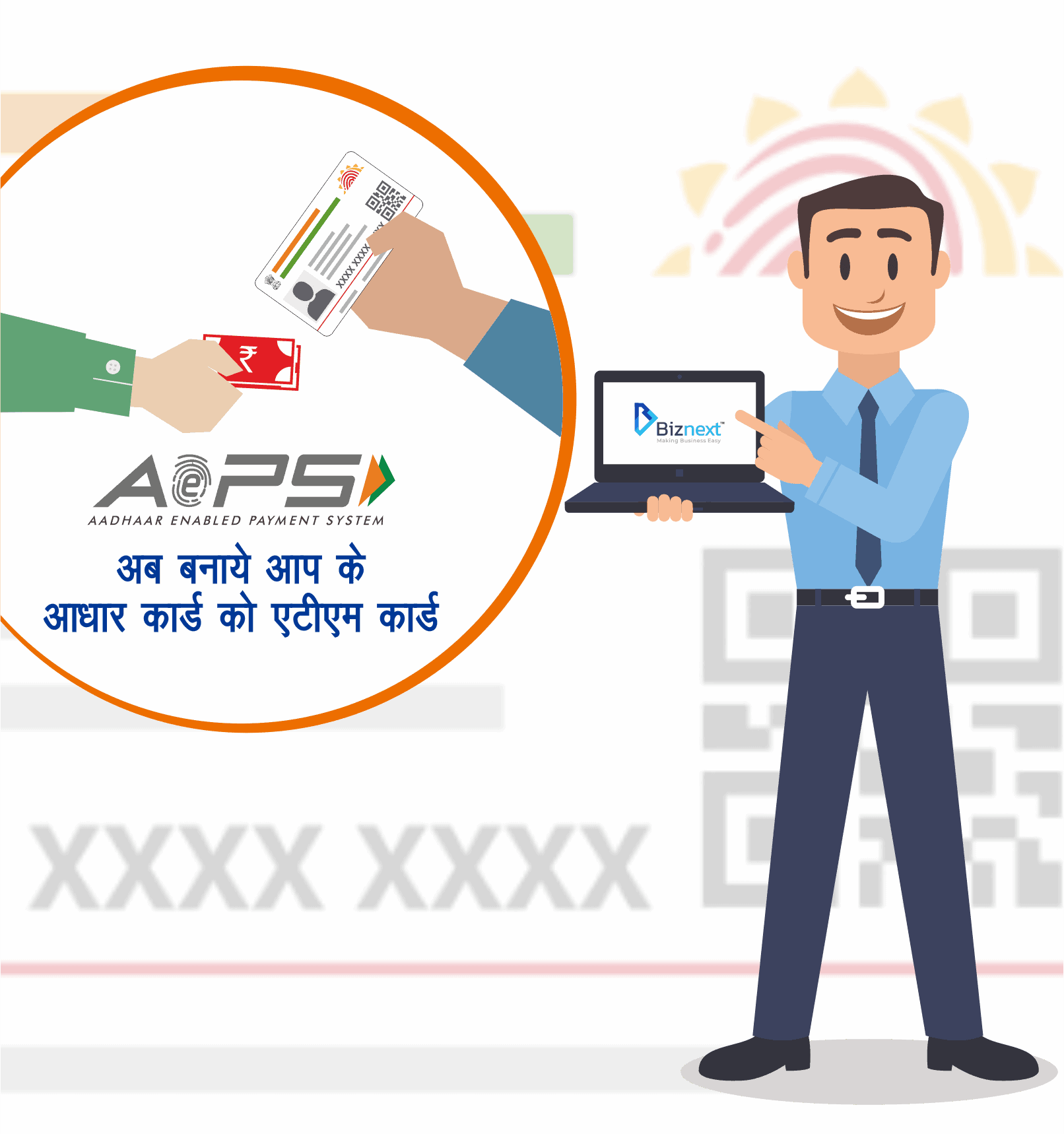

Aadhaar ATM:

Instead of searching for an ATM, AePS Agents of Biznext can convert their own store into an ATM using this service. Customers can withdraw money using their Aadhaar Number and finger print.

Mini statement:

Checking the mini statement of a customer has never been simpler. AePS Agent will also get a commission every time he checks the mini statement of the customer via AePS.

What is AePS?

Aadhaar Enabled Payment System(AePS Service), is an Aadhaar based payment solution which empowers bank users to carry out financial transactions (without any debit card/credit card/ cheque book) using only their Aadhaar card, registered with their bank account, and biometric authentication. AePS agents and distributors can provide basic banking services to their customers such as cash withdrawal, balance inquiry and obtaining a mini statement. It is an initiative by NPCI (National Payments Corporation of India) to support unbanked and underbanked sections of India.

At Biznext, we not only add the AePS Agent or AePS Distributor to our network, but also take steps to guide them in earning more. Anyone can join our network with a simple AePS Agent registration form that needs to be filled.

How Does AePS Work?

Once the AePS Agent registration is done, your Biznext AePS Agent login id will be generated. The process of AePS is very simple.

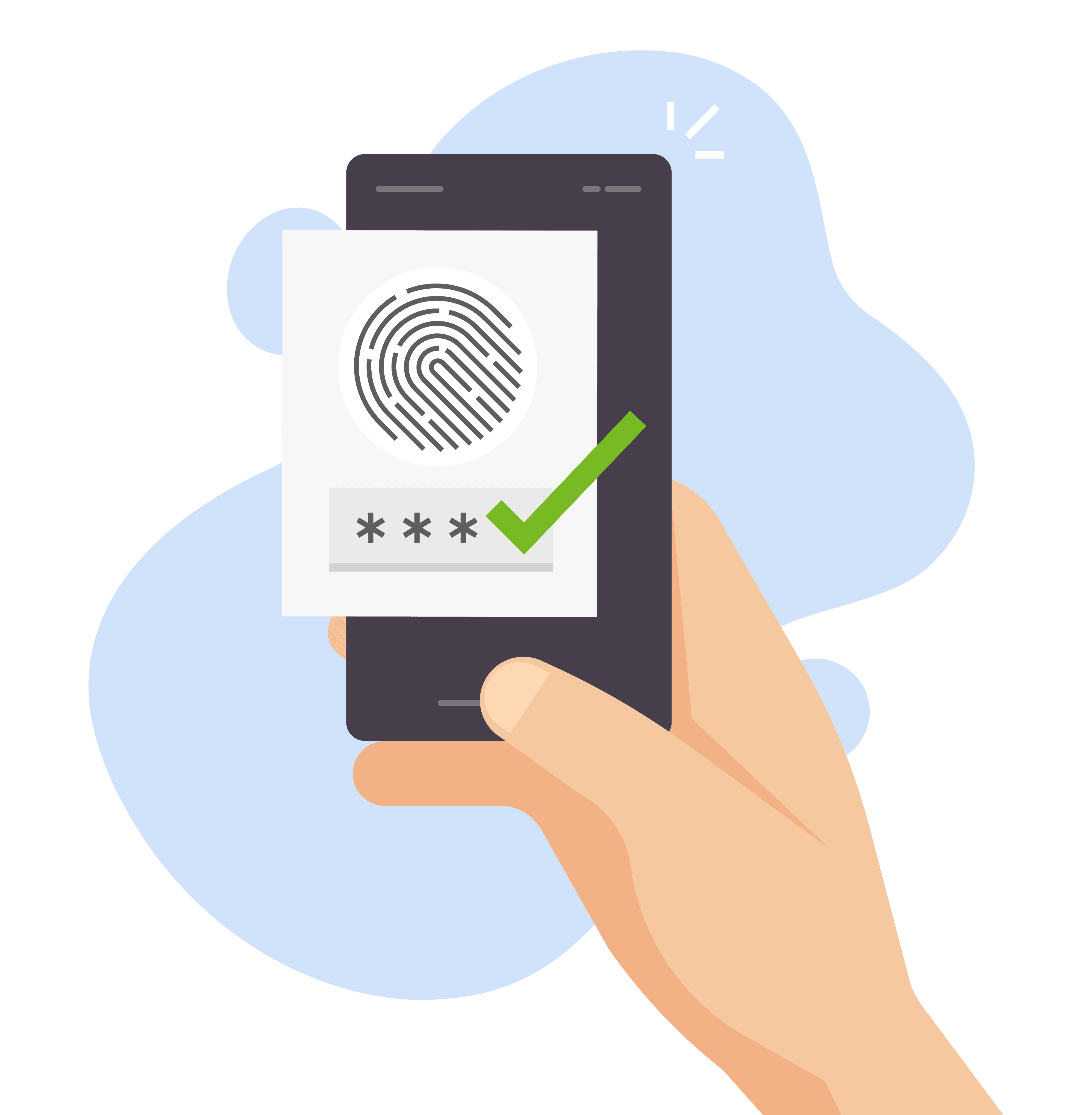

- The AePS Agent connects and installs a biometric device to their Computer or Smart phone.

- Agent inputs the Customer Aadhaar number and the bank name.

- Agent selects the transaction type: Cash withdrawal or Balance Inquiry.

- The customer then inputs their thumb print (same as per Aadhaar) to authenticate the transaction.

- The customer’s account is debited and merchant’s Biznext wallet account is credited real time along with additional commission amount.

- The AePS Agent then receives a transaction receipt and customer receives an SMS confirmation from bank.

Our AePS Portal Features

- Real Time Transaction Settlement along with commission

- Safe & Secure system.

- No need to carry a Debit or Credit card, Only the Aadhaar number and fingerprint authentication required.

- Easily withdraw money, avoid long queues at the bank or ATM.

- Quick process, doesn't take more than a minute to complete a transaction.

Benefits to AePS agent

- Minimum Investment with Maximum Return.

- Only requirements to set up business, are a Smart phone or Computer (as per ease and availability) & Biometric Device.

- Earn Attractive Commission per transaction.

- Quick process, takes less than a minute to complete the transaction.

- Full utilisation of cash in hand.

- Increase in customer base due to additional service provided.

Why Biznext For AePS Services

Real-Time Settlement:

AePS agents and Distributors get instant and real time settlement on every transaction.

Business Setup:

Ease of doing the AePS business setup with us, we will help you every step of the way.

Service Workforce:

Trained and experienced service workforce to help your AePS business flourish.

Transactions:

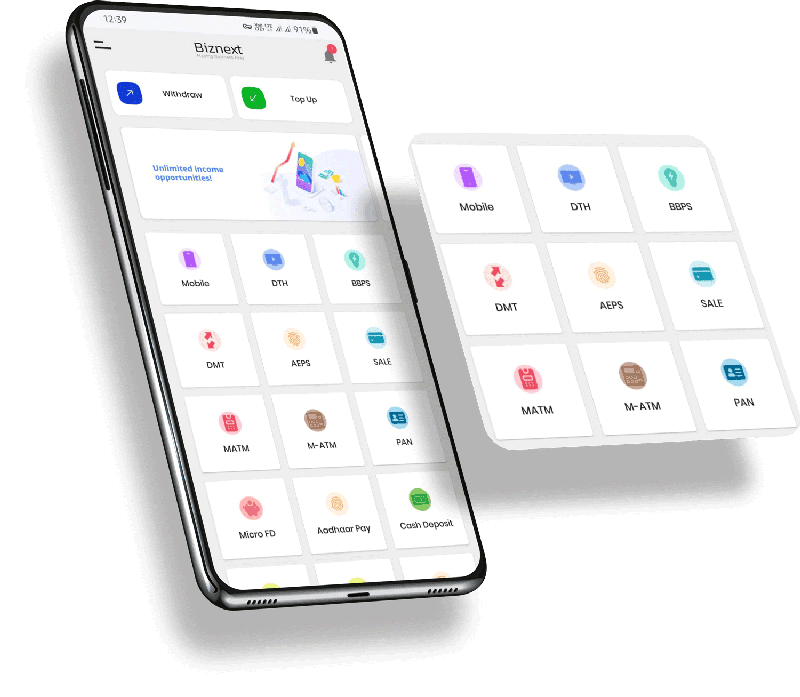

Save time by conducting transactions through Biznext Web Portal or Mobile Application.

Seamless Process:

Seamless process designed to reduce transaction time and effort using Biznext portal.

Zero Downtime:

Multiple banks integrated in the back end to ensure service is always up and running.

Activation Process

Any new or existing business partner can do AePS free portal registration with a simple documentation process. All you need to do is to submit your PAN Card and Aadhar Card and fill the Aadhar Enable Payment System / Aeps registration form. Earn a handsome income on every transaction!

Things required to start AePS Business?

- Smart Phone or Computer with an active internet connection

- Biometric Device